From Fear to Fortune: How to Overcome the Fear of Losing Money and Start Building Wealth

- Bill Shelmon Jr

- Jul 30, 2025

- 2 min read

Updated: Aug 27, 2025

Let’s face it—investing can feel like jumping into the deep end without knowing how warm the water is. The fear of losing money is real and valid, especially for new investors or those burned by market downturns. But staying frozen by fear can cost you more than any drop in your investment account.

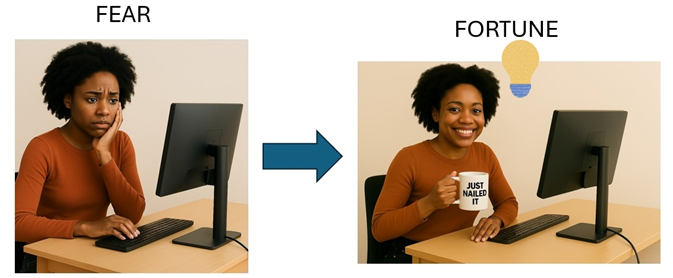

Here’s how to reframe from fear but instead fortune, build confidence, and take those first steps and start building long-term wealth:

💭 Understanding the Fear

Fear stems from uncertainty—and investing is full of it. Market volatility, news headlines, and stories of financial loss fuel hesitation. But here’s the truth: wealth isn’t built by avoiding risk—it’s built by understanding it and managing it wisely.

🎯 Strategy Beats Emotion

Becoming a smart investor isn’t fearless—it’s strategic.

Start Small: Begin with manageable amounts, whether it's $25, $50 or $500. Building confidence is easier when the stakes feel manageable.

Know Your Goals: Are you investing for retirement, a child’s education, or financial independence? Your strategy should mirror your purpose.

Diversify Wisely: Spread your investments across asset types to reduce exposure to any single financial risk.

📚 Knowledge Is Your Superpower to Fortune

Fear shrinks when you have a better idea about what you're doing.

Learn basic investment principles like compound interest, asset allocation, and time horizon.

Explore trustworthy investment platforms—so you can "practice" before committing real money.

Consider talking with an investment advisor who guides you along the way.

🔄 Learn to Minimize Risk

The real risk isn’t losing money—it’s missing out on not growing it. Yoy must overcome this fear.

Imagine this: $5,000 tucked in a savings account for 20 years might barely grow. But $5,000 invested in a diversified portfolio could double, triple, or more. While investing doesn’t promise gains, time and patience often reward disciplined investors.

🚀 Getting Started: The Gentle Launch

Not ready to make a full-blown dive? Dip a toe in:

Get started with low-cost index funds or ETFs.

Set up automatic monthly contributions—“set it and forget it” takes emotion out of the equation.

Track your progress quarterly—not daily. Think of it as planting a garden, you would not check the weather every hour.

💬 Final Thought: You Don’t Have to Go It Alone

We at Paycheck to Wealth believe wealth isn’t just built—it’s nurtured. If you’re ready to overcome the fear and begin your journey, let’s create a game plan that fits your life.

Remember when you invest intentionally, you’re not gambling—you’re growing. See the following graphic as a reminder to help you overcome the “Fear of Investing”.

Comments