top of page

Search

Using a Thrift Savings Plan (TSP) for $1 Million Wealth

It’s time to debunk a common myth: government employees can definitely become millionaires with their regular salary! It’s common for workers in the public sector to consider taking their skills to the private sector after gaining experience to start building wealth. But the good news is that public-sector workers can still build significant wealth over their careers—even becoming millionaires in the process. All government workers have access to a wealth-building vehicle c

Bryan Shelmon

Feb 254 min read

From Paycheck to Prosperity: Debunking the 3 Myths Keeping You From Building Wealth

We’ve all been there—staring at our savings account and wondering if “I’m saving enough" to actually make a difference. For so many, the biggest barrier to investing isn’t a lack of money; it’s a mountain of misinformation that we’ve come to believe as true. We need to debunk these 3 myths keeping you from building wealth. Stereotypes often paint a picture of investing that involves having a large amount of money, knowing the complex types of investments available, and payin

Bill Shelmon Jr

Feb 122 min read

Build Wealth For Your Kids Using The New Trump Accounts with $1,000 Jumpstart

How early should you start building wealth? After graduating from college? When you start working? When you’re at your peak earning potential? Well, what if we told you that you can begin as early as when you’re born? It’s never too early to start building wealth, and thanks to the new Trump Accounts, parents can start building wealth for their children the moment they are born! It’s a step in the right direction toward establishing generational wealth for your family, and

Bryan Shelmon

Jan 293 min read

2026 Investment Outlook: Riding High on the 4th Year of Market Gains and Wealth

After three consecutive years of double-digit market gains (2023–2025), it’s natural to feel a mix of excitement and a little bit of "waiting for the other shoe to drop." As long-term investors building wealth, if you’ve been consistently investing your paycheck, your investments likely looked better at the end of 2025 than it ever has. But as we step into the 2026 outlook towards wealth, the question isn’t just "Will the markets go up?" but "How do I protect and continue to

Bill Shelmon Jr

Jan 133 min read

2025 The Year in Review: 3-Years of Strong Market Gains

Riding the Wave: The Rarity of Three Straight Years of Double-Digit Market Growth If you have been a long-term investor and following your journey with Paycheck to Wealth in the last few years, you’ve witnessed something truly historic. As we close out 2025, the financial markets are on track to finish its third consecutive year of double-digit gains. To put it bluntly: This doesn't happen often. While it’s easy to get used to seeing double-digit gains with your investments,

Bill Shelmon Jr

Jan 13 min read

Will the Santa Claus Rally Deliver in 2025? What You Should Know

As we approach the end of 2025, we are once again asking: Will the infamous Santa Claus rally reward those who’ve stayed patient through another year of market twists and turns? After three consecutive years of robust stock market gains, the answer is not so straightforward, but let’s take a look at what the Santa Claus rally is and what it might hold for us this year. What Is the Santa Claus Rally? The Santa Claus rally refers to a seasonal pattern where U.S. stocks tend to

Bill Shelmon Jr

Dec 13, 20253 min read

‘Tis the Holiday Season to Give Thanks for Financial Success

Happy Black Friday! So far this holiday season has not disappointed. The financial markets are winding down what looks to be the third straight year of strong performance. Long-term patient investors have seen their investments grow in value over the last three years. That alone is enough to give thanks for a festive financial season. The climb has not been easy and there have been bumps along the way such as inflation shocks from higher prices, tariff shocks from the ne

Bill Shelmon Jr

Nov 26, 20252 min read

How Compound Interest Debt Works Against Wealth-Building

“Would you like to save an extra 10% today by signing up for our credit card?” We all have heard this simple phrase countless times when checking out at our favorite stores. It seems like the perfect offer when shopping to save a few extra dollars at the register. However, have you considered the long-term effects it has on your wealth-building? Retail shopping credit cards (along with several others) can be classified as high-interest credit cards and can set your wealth-b

Bryan Shelmon

Nov 13, 20254 min read

2025 October Halloween Surprises with Positive Market Uptrend

Spooky or not, historically, the fall is considered the slow period for stock market performance. Oftentimes, if September performs well, then October becomes the month when the financial markets might slow down. However, 2025 has been anything but normal. September had strong performances for all three major markets and October is building on that momentum. September saw the major market indexes climb from 1.87% for the Dow Jones to 5.61% for the NASDAQ. These are very

Bill Shelmon Jr

Oct 30, 20252 min read

Should You Consider Adding Alternative Assets (Bitcoin, Private Equity) to Your 401(k)?

On August 7th, President Donald Trump signed an executive order: Democratizing Access to Alternative Assets for 401(k) investors . If you currently have a 401(k) plan with your employer, then you’re one of the more than 90 million Americans impacted. According to the new executive order: “It is the policy of the United States that every American preparing for retirement should have access to funds that include investments in alternative assets when the relevant plan fiducia

Bryan Shelmon

Oct 14, 20255 min read

How to Use a 529 Plan as a Smart Way to Save for Your Education Like the Wealthy

Student loans are one of the major reasons why Millennials are experiencing a decrease in their net worth, according to Forbes . This...

Bryan Shelmon

Sep 10, 20254 min read

💰Why Reaching Your First $100K Is the Game-Changer for Building Wealth

Imagine a snowball rolling down a mountain. In the beginning, it’s small, slow, and needs a nudge. But once it gains mass and momentum?...

Bill Shelmon Jr

Aug 27, 20253 min read

Uncover Generational Wealth By Inheriting Real Estate

You’re not the only one feeling like homeownership is getting out of reach. According to the AP News , most Americans feel the exact same...

Bryan Shelmon

Aug 13, 20254 min read

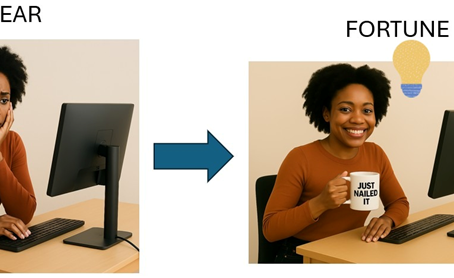

From Fear to Fortune: How to Overcome the Fear of Losing Money and Start Building Wealth

Let’s face it—investing can feel like jumping into the deep end without knowing how warm the water is. The fear of losing money is real...

Bill Shelmon Jr

Jul 30, 20252 min read

The Big Beautiful Bill: What It Means for Your Wealth

On July 4, 2025, President Trump signed into law the sweeping “One Big Beautiful Bill Act,” a nearly $4 trillion tax-and-spending package...

Bill Shelmon Jr

Jul 14, 20252 min read

6 Tools to Replace Your Salary for Financial Freedom

We’re all dreaming of the day when we can walk away from our jobs and finally start living our dream lives! Financial freedom is the...

Bryan Shelmon

Jun 11, 20255 min read

The Remarkable Turnaround in the Financial Markets Since April 2025

The financial markets have staged an extraordinary recovery since President Trump announced “Liberation Day” by enacting tariffs in early...

Bill Shelmon Jr

May 28, 20252 min read

Social Security + $750,000 Easily Gets You Over Your $1 Million Retirement

Many people often think about $1 Million as a special financial milestone to reach in order to have financial security. However, what...

Bill Shelmon Jr

May 14, 20253 min read

Learn to Unlock Passive Income by Investing in Real Estate Investment Trusts (REITs)

Did you know that real estate is considered the greatest wealth creator in the world? Whether you own a commercial real estate empire or...

Bryan Shelmon

Apr 29, 20254 min read

Worry and Fear Are Not an Investment Plan for Managing Your Declining 401(k) and IRA: (What’s Needed for Peace of Mind)

The last few weeks have been very challenging in the financial markets. The big swings, both up and down, are enough to have your head...

Bill Shelmon Jr

Apr 13, 20253 min read

bottom of page